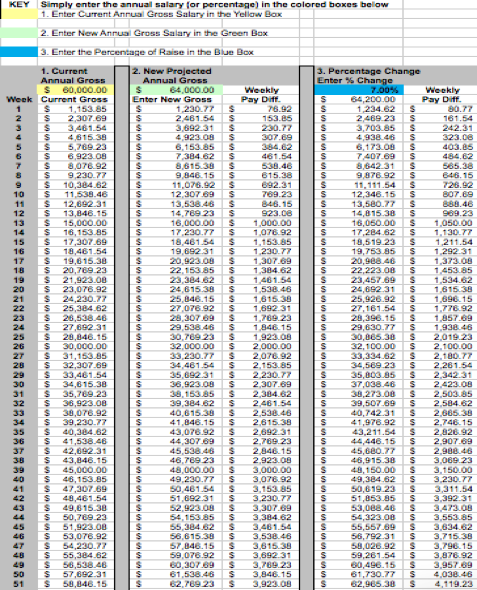

Yearly gross income calculator

Personal tax credit for people with low income in the Netherlands - 2477 euros. Enter the gross hourly earnings into the first field.

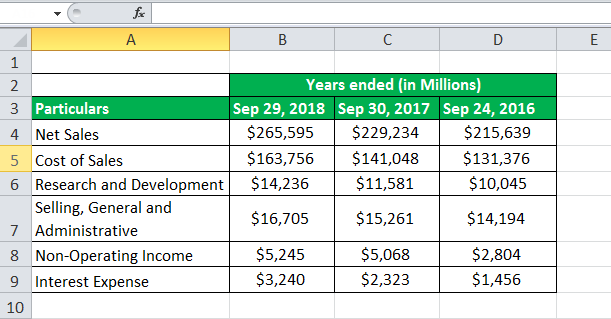

Total Income How To Calculate Total Income Tax2win

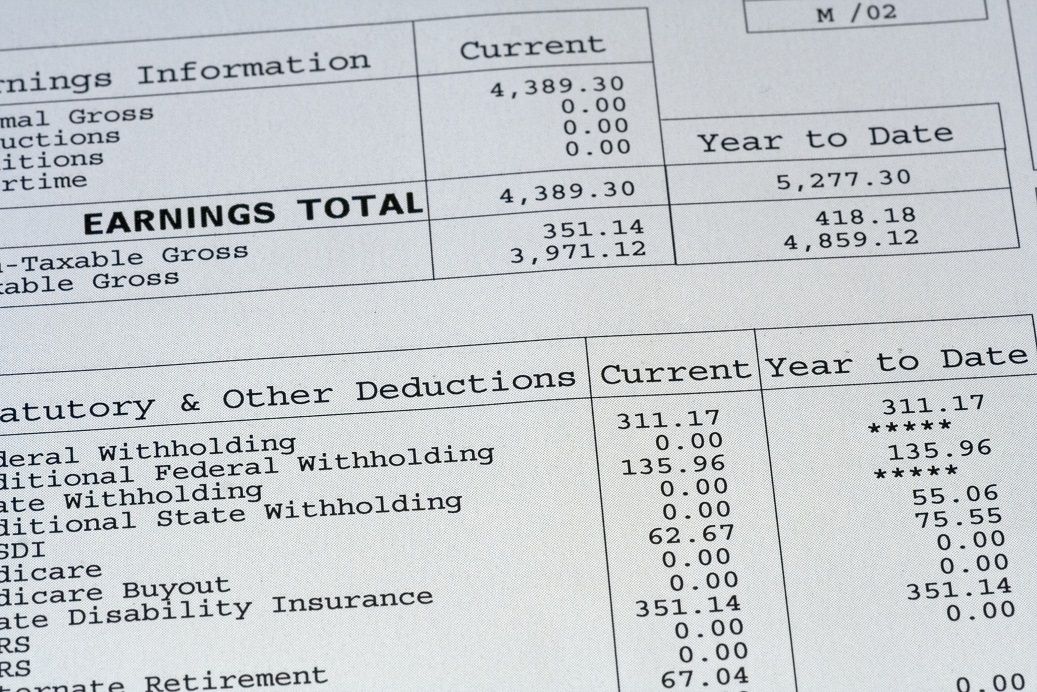

But calculating your weekly take-home.

. The calculator calculates gross annual income by using the first four fields. If you make 55000 a year living in the region of New York USA you will be taxed 11959. The Income Tax is calculated on the basis of the income tax slab applicable to the taxpayer and the net income.

Below is an individual income percentile calculator for the United States. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. That means that your net pay will be 43041 per year or 3587 per month.

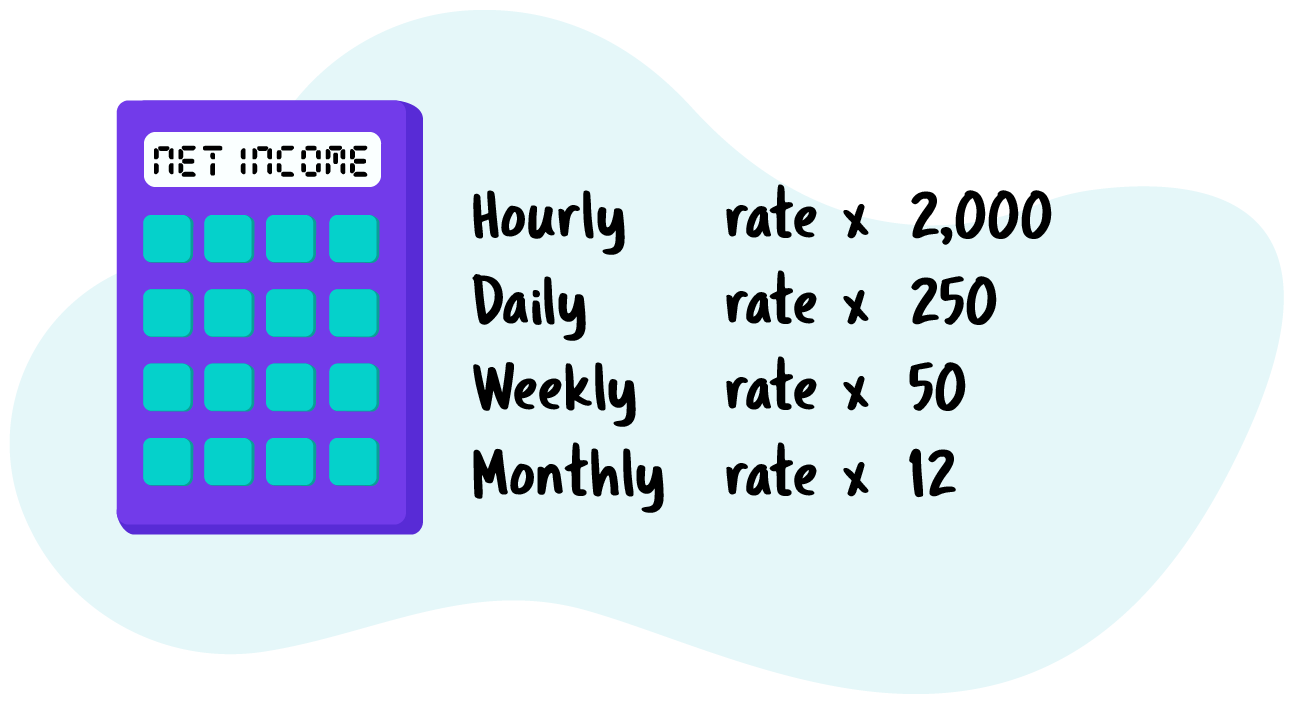

Use this calculator to see how inflation will change your pay in real terms. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Annual Income 15hour x 40 hoursweek x.

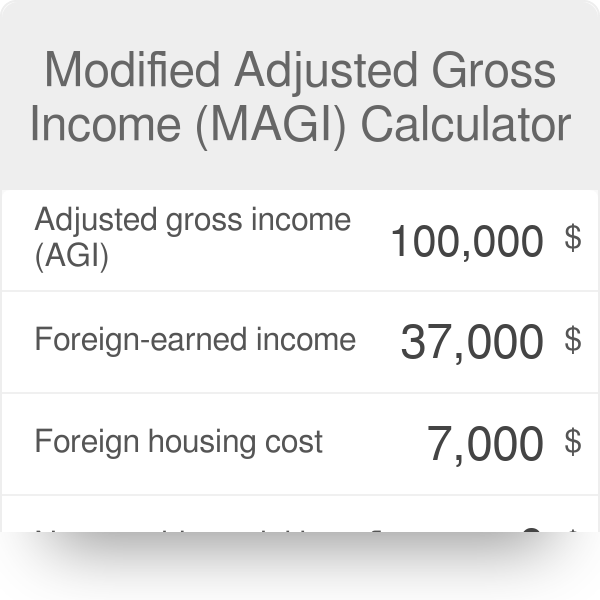

Enter pre-tax gross income earned in full-year 2020 January to December to compare to the US individual. With five working days in a week this means that you are working 40 hours per week. You can calculate your AGI for the year using the following formula.

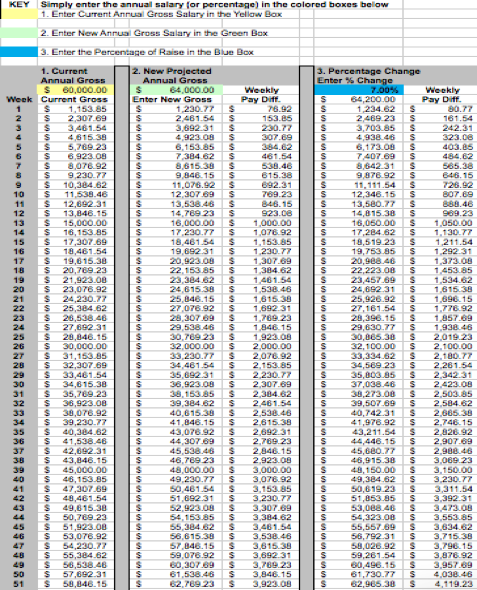

To determine your hourly wage divide your. Enter the year-to-date income in the YTD box then choose the start and finish. The average full-time salaried employee works 40 hours a week.

The tax rate on income from savings and. All other pay frequency inputs are assumed to be holidays and vacation. Input the date of you last pay rise when your current pay was set and find out where your current salary has.

Multiply the amount of hours you work each week by your hourly salary. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Get a quick picture of estimated monthly income.

How Your Paycheck Works. In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work. Gross income the sum of all the money you earn in a year.

To convert from your net annual income to your gross annual income you can use this simple formula. Multiply that amount by 52 the number of weeks in a year the number of weeks in a year. When filling out your application youll be shown the expected yearly income.

If the amount shown is. The procedure is straightforward. Using the annual income formula the calculation would be.

This yearly salary calculator will calculate your. Net income 1 - deduction rate For example if your net income was. This online calculator is excellent for pre-qualifying for a mortgage.

Write down the net expected income for coverage year or download and save the PDF. Year to Date Income. Based on this the average salaried person works 2080 40 x 52 hours a year.

AGI gross income adjustments to income. You can follow the following steps to calculate the income tax for any financial. Gross Annual Income of hours worked per week x.

Taxable Income Formula Examples How To Calculate Taxable Income

Annual Income Calculator

Income Calculator Online 53 Off Www Ingeniovirtual Com

Hourly To Salary Calculator

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

4 Ways To Calculate Annual Salary Wikihow

Excel Formula Income Tax Bracket Calculation Exceljet

3 Ways To Calculate Your Hourly Rate Wikihow

Magi Calculator What Is Magi

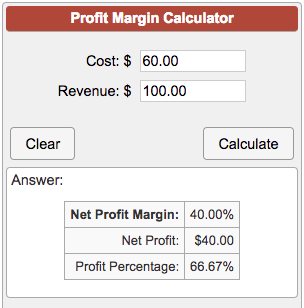

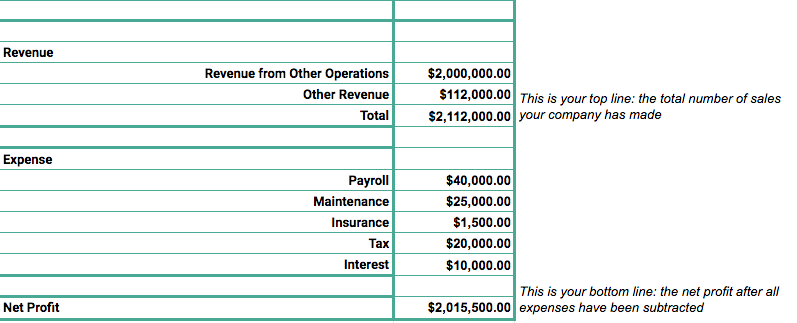

Profit Margin Calculator

Taxable Income Formula Examples How To Calculate Taxable Income

Monthly Interest Income Calculator Kurortstroy Org

Yearly Income Calculator Online 55 Off Www Ingeniovirtual Com

Gross Pay Definition Components And How To Calculate

Annual Income Calculator Flash Sales 52 Off Www Ipecal Edu Mx

Taxable Income Formula Examples How To Calculate Taxable Income

Sales Revenue Formula Calculate Grow Total Revenue